Millburn Promotes Michael Soss to Chief Investment Officer

Millburn announces the promotion of Michael Soss to Chief Investment Officer.

Irina Bogacheva: One of the 50 Leading Women in Hedge Funds

The Hedge Fund Journal recently selected Millburn's Director of Research, Irina Bogacheva, amongst the 50 Leading Women in Hedge Funds for 2024.

Revisiting the Ripple Effects of Commodity Disruption

Millburn’s co-CEO Barry Goodman revisits his thoughts on disruption in the commodity markets, including the spillover into other asset classes.

.png)

China: Investing in Uncertainty (Part Two)

The following is another excerpt from a paper published by co-CEO Barry Goodman last month about Millburn's experience investing in China.

China: Investing in Uncertainty

The following is the first installment of our newly published paper written by co-CEO Barry Goodman about Millburn's experience investing in China.

Expanding Opportunity Sets in Quant

Barry Goodman shares how the firm has evolved beyond momentum into an innovator in the application of multi-data AI models—and their application to China.

.png)

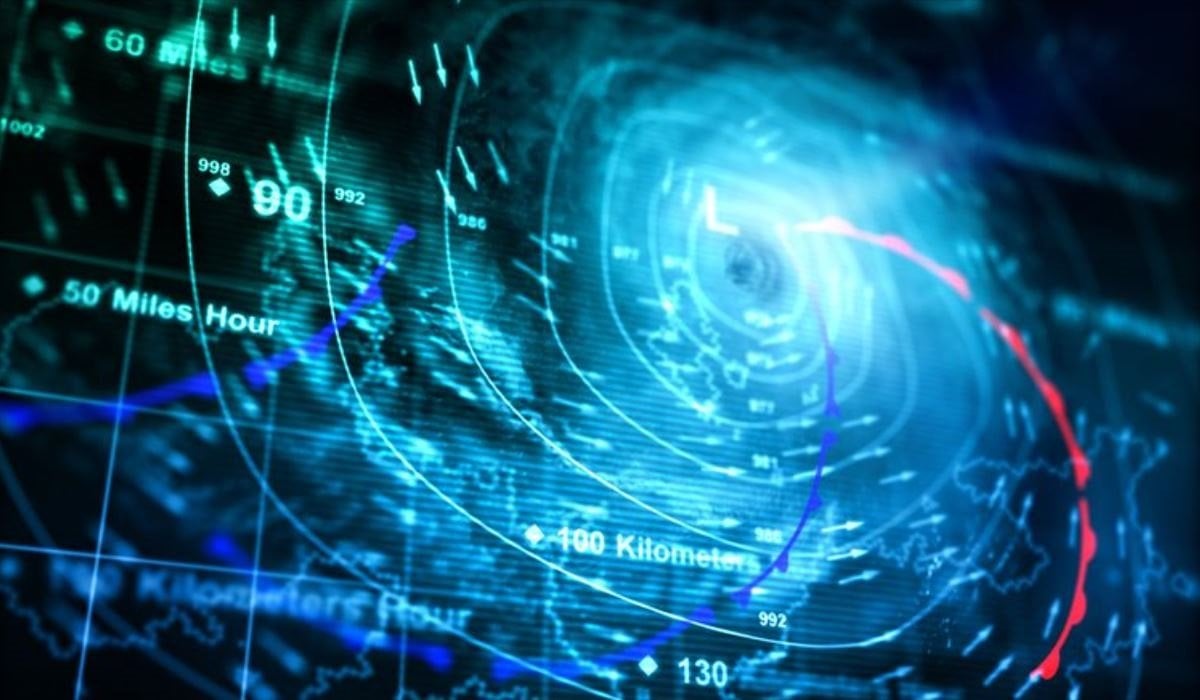

VUCA and The Disruption Vortex

Hear from co-CEO Barry Goodman how 2022 may have ushered in a new era of Volatility, Uncertainty, Complexity and Ambiguity, and how investors may respond.

Irina Bogacheva Joins Millburn as Director of Research

Irina Bogacheva has been hired as the Director of Research, reporting to Michael Soss, deputy CIO.

The Ripple Effects of Commodity Disruption

Millburn’s co-CEO Barry Goodman discusses disruption in the commodity markets, including the spillover into other sectors and how investors may respond.

Millburn’s Renowned Commodity Acumen: The Hedge Fund Journal

An excerpt from a recent story by The Hedge Fund Journal on a new strategy that harnesses disruptive themes in Chinese and global markets.

Data, in context.

Millburn believes that developing a clear picture requires looking at different types and sources of information—simultaneously and in context of one another.

This is why we take a contextual approach to quantitative investing, relying on data, but more specifically on the way that data interact. In terms of the markets and instruments in which we invest, this means utilizing multiple features and an inclusive approach that seeks to better explain (and predict) the direction and magnitude of returns.

Powerful technology and substantial market knowledge combine to find repeatable patterns in historical data.

Millburn's investment approach combines substantial market experience—including live trading through many market cycles and periods of historical stress—with a rigorous, data-driven approach to quantitative analysis. Working from a proprietary statistical framework, the process has proven effective in translating ideas into robust, measurable investment strategies, portfolio constructs and risk management practices.

Millburn’s process is data-driven, risk managed and adaptive.

Data-Driven

Millburn's investment process is focused on data and an evidence-driven understanding of market behavior.

Our R&D team focuses primarily on the use of a machine learning framework to evaluate markets using a wide range of features, including price, price-derivative and non-price data, in various combinations.

Our research suggests that this approach offers an informational advantage over more traditional evaluation methods, enabling us to make decisions about the direction, size, and sustainability of price moves. Further, we believe the process can be used to improve trade execution through the incorporation of return forecasting, enabling us to evaluate potential trades, before they are placed, in the context of overall profitability.

Technology-Focused

Technology forms the backbone of our research and investment capabilities and is a key part of our culture.

Through the incorporation of leading-edge data tools, trading systems and networking, our approach benefits from significant ongoing investment in technology.

This focus enables our researchers to create, simulate, implement and monitor our strategies with confidence and speed.

Iterative and Adaptive

Our process is iterative, seeking continuous improvement and refinement.

Because our strategies are systematic in nature, key knowledge resides in our core systems rather than with any particular person, which means our process can make use of our decades of development and live trading experience, now and in the future.

Machine learning models learn autonomously over time as the latest data is incorporated and evaluated, helping strategies keep pace with regime shifts.

Risk Managed

Risk management is in our DNA.

Millburn seeks to manage risk carefully in its investment programs, with the goal of providing superior risk-adjusted returns, and minimizing drawdowns, across a variety of market environments and over a range of time-frames.

We believe strong risk management is effected through ongoing research and monitoring of our investment strategies, but that it fundamentally originates from a mindset of humility and an understanding of the responsibility we have for your invested assets.

The result: diversifying strategies for more robust portfolios.

Millburn’s investors range from individuals to some of the largest institutions in the world. Investment solutions utilizing our quantitative approaches include systematic long/short strategies, to meet a range of investor needs.

We look forward to working with you.

Contact us to learn more, or to receive information on our strategies.