Millburn’s Renowned Commodity Acumen: The Hedge Fund Journal

The following was prepared by a third party unaffiliated with Millburn. Please see the important disclosures appearing here (https://www.millburn.com/disclosures) and below. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE POTENTIAL FOR PROFIT IS ACCOMPANIED BY THE RISK OF LOSS.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Millburn Ridgefield Corporation, its affiliates or its employees.

This document has been provided to you solely for information purposes and does not constitute an offer or solicitation of an offer or any advice or recommendation to purchase any securities or other financial instruments and may not be construed as such. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such.

Without changing the substance of the article, certain elements have been redacted to comply with regulatory restrictions.

Prospective investors should note that any published rankings, awards or similar groupings have inherent limitations and qualifications, such as limited sample size, imperfect access to information, and other considerations. There can be no assurance that the universe upon which the awards were based included all investment products within each category that are actually in operation or existence. These awards are not indicative of Millburn’s past or future performance or the future performance of any strategy referred to herein. They are also not indicative of a particular investor’s experience or the future performance of the strategies based upon which the awards were granted. This information is included solely for background purposes and should not be used as a basis for an investment decision regarding an investment. The awards and rankings referred to herein were compiled and published by The Hedge Fund Journal and are based on estimated performance reported by Preqin Ltd managers. The award was part of The Hedge Fund Journal’s 2021 Awards for the Systematic Commodities – Mulitstrategy category. Managers that do not report performance to Preqin Ltd, are not eligible for this award or ranking. As the rankings are based upon estimates reported to Prequin Ltd, when final performance is reported, it might not match the position awarded and the strategy or manager could have moved up or down in the rankings. Awards reflected herein are granted on a risk-adjusted basis over the following time periods: 2020; over two years; over three years; and over five years. Any awards or ratings disclosed herein were based on criteria formulated by The Hedge Fund Journal and without input or compensation from Millburn. Millburn is unaware of any undisclosed facts that may be relevant to the award discussed herein.

For Qualified Eligible Person Investors Only

The Hedge Fund Journal, February 2022

Article excerpt republished with permission of THFJ

By Hamlin Lovell

***

Want access to other occasional items or updates? Just provide your information below.

Millburn’s Renowned Commodity Acumen

Investors embrace diversification, inflation and “greenflation”

New York-based Millburn Ridgefield Corporation’s longevity and dynamic, evolutionary analytical approach can make it an attractive employer for seasoned quants. Case-in-point: in January 2022, Millburn hired Dr. Michael Soss in the newly created role of Deputy Chief Investment Officer, from Point72. Soss, who reports to Millburn co-CEO, Grant Smith, said: “What really drew me to Millburn is the team’s fifty years of success in quantitative investing combined with a drive for constant improvement…”

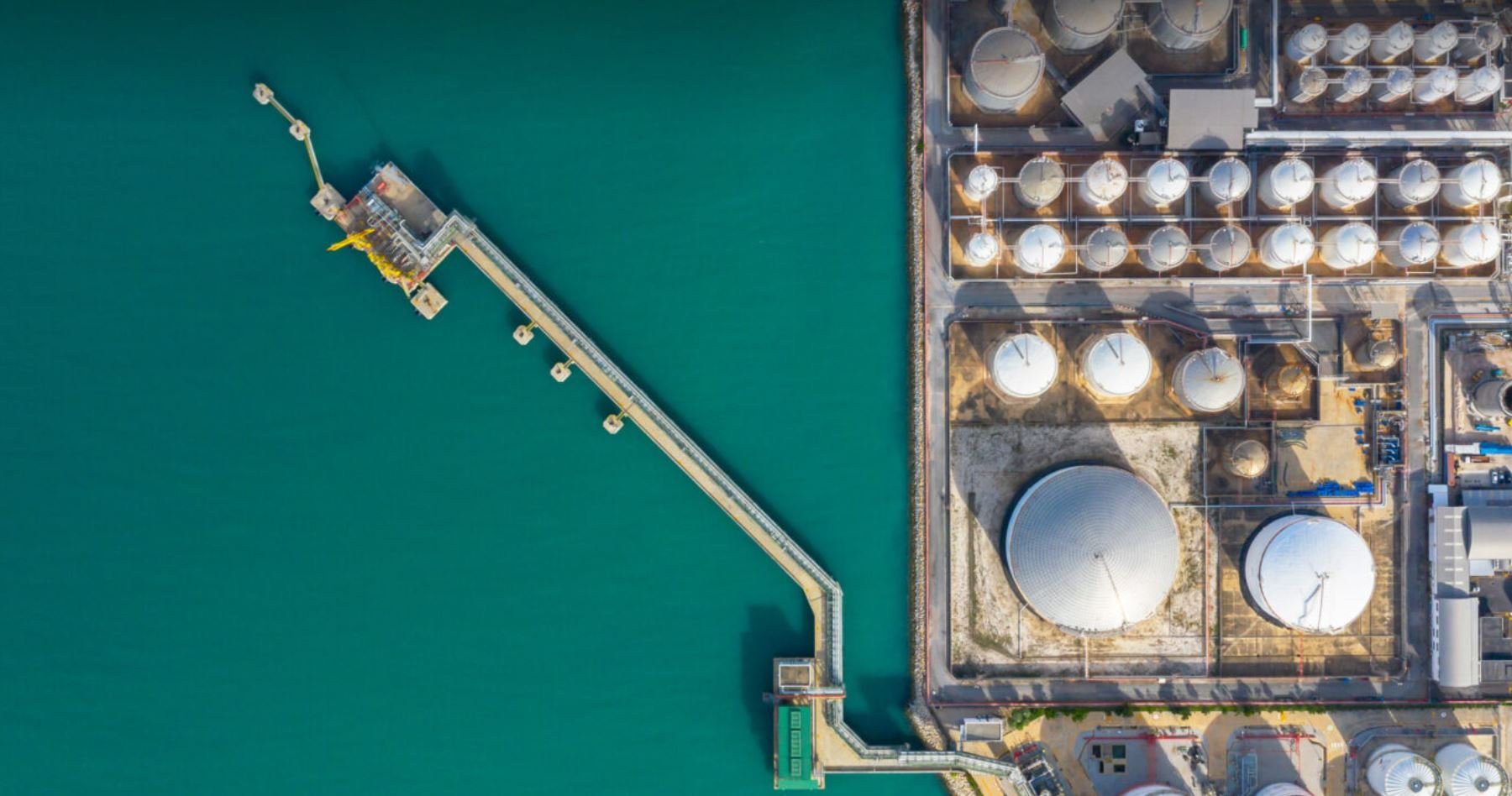

Commodities have always been a big part of the Millburn story and have developed into a key differentiator for the firm, which has invested in liquid commodity markets since the firm’s inception in 1971. Having systematically traded these markets for over 50 years makes Millburn one of the few that has survived through volatile markets and shifting regimes that have seen multiple generalist and specialist commodity funds shut down after performance setbacks.

Millburn has traded through commodity super-cycles dating back to the 1970s, when US dollar depreciation following the breakdown of the Bretton Woods fixed exchange-rate dollar standard system coincided with broad-based price inflation in commodities, and in the 1990s and beyond, when China’s modernization drove a wave of demand that kept prices elevated for years. Millburn has also had success trading commodities through extended periods of declining prices, such as 2012-2019. The manager has additionally navigated periods of more choppy, range-bound, and sideways price action in commodities. Of course, while Millburn seeks profit, it is also accompanied by the risk of loss.

“Commodities is a very large category, and markets within the category can behave quite differently, driven by different inputs…. we take an active approach that treats each market individually.”

Millburn has traded commodities in multi-asset class programs from the start and has also launched dedicated pure play commodity strategies, such as its Commodity Program, which underscores the firm’s belief in the sector. Generally closed to new capital since early 2018, the strategy was recognized in July 2021 as the winner of The Hedge Fund Journal’s award for Best Performer in the Systematic Commodities – Multistrategy Category. Importantly, the correlation of the strategy versus traditional global equity, global fixed income, and typical hedge fund strategies over each noted timeframe has been negative, which has added to the attraction in terms of diversifying an investor’s portfolio.

The Commodity Program continues to grow assets organically through performance while a new commodity strategy launched in June 2021, the Resource Opportunities Program (ResOP), managing an extensive suite of traditional and next-generation commodity and resource-related markets, is open to investors. The global investor base includes existing and new investors, such as sovereign wealth funds in Asia and family offices in the US. And further, for investors looking to capture more beta from a potential super-cycle (while still tactically adjusting exposures across different markets and sectors according to the opportunity set), the long-only Dynamic Commodity Strategy (DCOM), launched around the same time as ResOP, provides another option.

Diverse perspectives on commodity diversification benefits

A growing variety of investors are warming to commodities. While Milburn’s belief in the benefits of including commodities in portfolios has remained constant through the decades, a broader range of investors recently appear to be now reaching similar conclusions. Inflation is now expected to be more than transitory, thanks to massive liquidity injections from global central banks, fiscal largesse, and the prospect of extended supply chain disruptions. Infrastructure investment, partly related to green ambitions, is another theme driving demand, while commodities can also act as a hedge against a weaker US dollar. Many investors are focused on these and other macro trends as the world emerges from the fastest, deepest, and broadest economic shock in recent history.

Jeff Currie, Global Head of Commodities Research in the Investment Research Division of Goldman Sachs, sees a long bull market ahead. Last year he said: “Not only have oil, metal, and agriculture prices rallied year to date, but structural impediments on supply have created sustainable deficits, in our view, giving commodities broad-based positive carry…as we have argued since October last year, we believe this is the beginning of a new structural bull market in commodities, and with every market but cocoa and zinc in a deficit we maintain our conviction in this view”.

He also stresses the diversification potential from the asset class, pointing out that: “commodity diversification is back as returns have decoupled from other asset classes”. Indeed, there have been several recent episodes when oil and other commodities have provided prima facie diversification: they have delivered double-digit gains while bonds and equities sold off precisely on fears of inflation and rate rises.

While the last decades-long down move in commodities has been dubbed a “lost decade” for long-only investors and made it harder to stay invested, the historical non-correlation of the asset class to traditional global equity and bond investments is attractive and has been quite consistent. Now, with equities hitting all-time highs and the potential for a downturn increasingly on investors’ minds, and with bonds offering negative real yields in US Dollars (and negative nominal yields in many currencies) becoming less attractive as a source of income, this non-correlation may be even more important.

“Not only have oil, metal and agriculture prices rallied year to date, but structural impediments on supply have created sustainable deficits, in our view, giving commodities broad-based positive carry…as we have argued since October last year, we believe this is the beginning of a new structural bull market in commodities...”

And with inflationary fears now moving into mainstream forecasting, it is worth noting that commodities have often historically performed well in such environments, offering a potential hedge for investor portfolios, especially if they are US dollar-dominated.

Since commodity prices are set at the margin a small supply/demand imbalance can translate into an out-sized move, with strong demand or low supply generally pushing prices higher, all else equal.

When these factors coalesce in a synchronized way, opportunities for violent moves can materialize.

Next-generation commodities and decarbonization

Beyond this classic investment thesis for the asset class, Millburn has also recognized that the commodity space itself is evolving and has expanded its universe into what they call “resource disruption,” which includes instruments providing exposure to next-generation commodities like wind, solar, water, battery technology, cryptocurrencies and more. While trading through exchange-listed futures remains the bedrock of most programs, securities trading is of growing importance to Millburn in terms of accessing those evolving next-generation opportunities for which liquid, exchange-traded futures markets may not yet exist.

Next-generation commodities can tap into multi-year megatrends driven by policy, regulation, and technology. Wind, solar, and hydropower are related to the global commitment to decarbonization, and there is scope to trade trends based on moving from brown to green, or indeed from “light green” to “dark green” as the distinctions between different energy sources become more nuanced.

If electricity (and perhaps eventually hydrogen) can replace oil and gas for many use cases, that can engender strong trends: “We have an exciting new world of electrification and environmental awareness, which is opening up entire new opportunities to invest, and is creating price trends as a result. We see these investments as providing incredible potential sources of diversification and alpha for our investors,” says Barry Goodman, Millburn’s co-CEO.

Greenflation

Green economics could already be stoking “greenflation” that upends the arguments for long-term commodity price deflation: starving some resource producers and explorers of capital, and increasing their costs of capital, has the possibly unintended consequence of choking off supply of traditional energy and renewable energy cannot yet fill the gap due to issues of seasonality, weather sensitivity, and intermittency, and the fact that battery technology is not yet able to store enough electricity. Goodman explains: “There’s the idea that traditional commodity prices have been trending down as technology improves and, for example, it becomes easier (that is, less costly) to extract a barrel of oil from the ground or to mine copper. But there are also potential forces that can run counter to this and, in some cases and potentially for extended periods of time, can result in prices that rise significantly. Decarbonization has meant less investment in the infrastructure needed to extract a barrel of oil, for example. So the fragility of the oil supply has increased, and the potential for price shocks has grown. That is just one example, but it is really this period of incredible transition that we are seeing that we believe has the potential to produce trading opportunities.”

“Decarbonization has meant less investment in the infrastructure needed to extract a barrel of oil, for example. So the fragility of the oil supply has increased, and the potential for price shocks has grown. That is just one example, but it is really this period of incredible transition that we are seeing that we believe has the potential to produce trading opportunities.”

Indeed, a scarcity of capital production and exploration not only increases prices but also adds to volatility. Millburn are not running standalone ESG programs or strategies per se but may be well positioned to profit from extreme trends in some markets, such as record-breaking natural gas prices in Europe and Asia in 2021 and all-time high carbon emission prices in 2022. European carbon futures listed on the ICE exchange are one example of a deep and liquid market that fits into Millburn’s programs well.

Why a bottom-up, tactical approach?

Though Millburn appreciates the arguments for being broadly constructive on commodity markets, they believe in the importance of staying flexible and nimble in their trading approach. “Even if we believe in the diversification benefits of adding commodity investments to a portfolio, and even if we believe we may be entering into a new phase of growth for commodity markets in general, the experience is unlikely to be singular. Look under the hood of the last super-cycle or examine even the recent surge in commodities more closely. When you do so, it becomes clear that moves have not been uniform. It may be, then, that only a subset of commodities enter into a true super-cycle, while others move only into what might more properly be described as cyclical bull market behavior. For example, global demand for copper and aluminum, combined with low inventories, may drive true, sustained super-cycle behavior in those instruments. But other markets may react in different ways. Perhaps crude oil will take a different path. Simply put, commodities is a very large category, and markets within the category can behave quite differently, driven by different inputs,” says Goodman. “This is why we take an active approach that treats each market individually”. In 2021, lithium more than trebled in price and other metals used in electric vehicles posted double-digit gains while another base metal – iron ore – saw double-digit losses, as did some precious metals, including silver and platinum.

Even 2021, arguably an excellent year for commodities, did not always see the most synchronized and uninterrupted rallies. Iron ore saw reversals of more than 50%, and even the largest commodity markets such as crude oil experienced pullbacks of the order of 30% in a few weeks, with both realized and implied volatility reaching extreme levels.

As a result, the bottom-up tactical approach resonates with investors who are contemplating how to take advantage of the tailwinds of a potential commodity super-cycle in both traditional and “next-gen” markets while allowing for the possibility that different commodities will likely move up in fits and starts, on different timeframes, and with different factors of influence.

Millburn addresses these challenges with its typical approach to all asset classes: diversify among as many markets as possible, include inputs into its models that are believed to pick up on sustainable market moves, and control risk both systematically and through constant monitoring. In sum, it is a machine and human approach that uses technology but always in the framework of what the firm believes are sound money-management principles.

Models tailored to commodity markets

The models also adapt to the unique features of commodity markets. As an example, term structure tends to be especially important for commodity markets, because the forward curve shape can significantly contribute to, or detract from, returns.

Millburn has synthesized decades of experience and evolved into an eclectic approach that uses a variety of fundamental and technical data inputs, acknowledging that market dynamics are driven not only by supply and demand but also by behavioral factors and investor sentiment. These models are positioned to potentially capitalize on the coming megatrends in certain commodities and resource-related markets while also heeding the need for risk controls in relation to diversification, volatility, and downside controls and aiming to generate attractive risk-adjusted returns that have secured its performance awards.●

***

IMPORTANT DISCLOSURE AND RISK INFORMATION

This article was prepared by an independent third party, based in part on information provided by Milburn Ridgefield Corporation and its affiliated entities. No compensation was paid to the author or publisher of the article or any other person in exchange for publication of the article; however, Millburn has paid for the rights to reprint the published article. Millburn Ridgefield Corporation is the successor to an asset management organization that first began its operations in 1971. The term Millburn is used herein to refer to the activities of Millburn Ridgefield Corporation, its predecessors and its affiliated entities, except as indicated otherwise by the context.

This article reprint is not an invitation to invest in any investment strategy managed by Millburn but rather describes its approach to investing generally. The purpose of distributing this article is to provide further insight into Millburn s investment approach. This article is based on information available as of the date indicated. Any markets, models, leverage, portfolio weights and other data described herein change over time, but are accurate as of the date indicated herein. This presentation is not an invitation to invest in any investment strategy managed by Millburn and must be supplemented by certain disclosure when considering an investment, including important information concerning risk factors, conflicts of interest and other material aspects of an investment, which must be read carefully before any decision whether to invest is made. Investors may lose all or a substantial amount of their investments.

The information contained herein is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Neither Millburn nor the author guarantees the accuracy, adequacy or completeness of such information. Neither Millburn nor the author assumes any duty to, nor undertakes to update forward looking statements. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE PERFORMANCE. THE POTENTIAL FOR PROFIT IS ACCOMPANIED BY THE RISK OF LOSS.

Commodity interest accounts are illiquid, speculative, employ significant leverage, and involve a high degree of risk. Commodity interest accounts involve high fees. There can be no assurance that an investment strategy will achieve its objectives.

NOTES TO PERFORMANCE

Estimated performance results are subject to final verification. Because it is difficult to attribute each actual position held by an account to a particular sub-strategy employed by that account, performance attribution by sub-strategy and net risk exposure are estimated based on internal calculations employing the sub-strategy and market weights utilized by the strategy. Accordingly, estimates may not precisely represent the positions held or results achieved by the strategy in actual trading.

Millburn Commodity Program (“MILCOM”) returns are net of all fees, expenses and transaction costs (2% per annum management fee; actual transaction costs; 0.25% per annum ordinary operating and administrative expenses; 20% annual profit share, subject to a high water mark), and reflect the reinvestment of profits.